Google has launched a mortgage tool in its search results in the US market.

The tool has been launched in partnership with The Consumer Financial Protection Bureau (CFPB), the organisation responsible for regulating the offering and provision of consumer financial products and services in the US.

The news comes as Google confirms that demand for topics such as ‘how to buy a house’ and ‘refinancing’ have been at an all-time high over recent months.

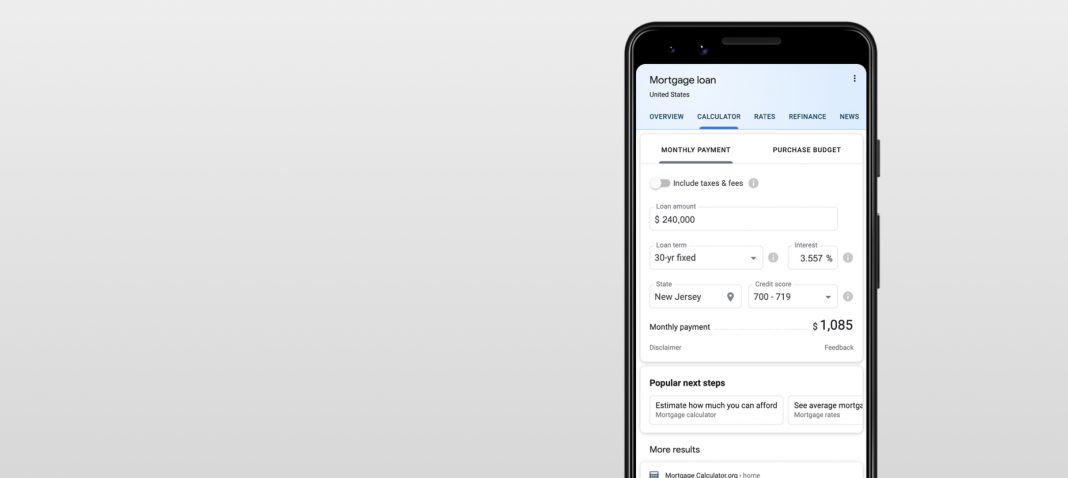

The mortgage tool will appear on mobile searches and is intended to help users to better understand the mortgage process. The new feature will serve customers who are at any stage within the mortgage process, providing information and guidance along the way.

Features include guidance on common language and terms used in the industry, an overview of the mortgage selection process, a repayment calculator and a feature to compare available mortgage rates.

Global expansion?

The new tool is currently only available in the US market where the CFPB operates and so it remains to be seen whether Google will partner with other international organisations to roll this out in other countries.

UK financial institutions will be keen to know whether plans are in place for Google to partner with the FCA to deliver a similar service in this country.

A Google land-grab…

Critics of Google’s tendency to deliver services and search features that consume increasing amounts of screen real estate may see this launch as further evidence of Google’s self-serving habits.

The new tool means that searchers using Google to find mortgage information and offers will see fewer results from third-party sources, something finance firms are likely to be troubled by.

Search marketing news provider, Search Engine Journal also made some troubling findings on the ‘mortgage’ search results page, stating that “one of the FAQs [that sits beneath the new tool] has content that appears to have been sourced from BankRate.com. But there is no link to the source of the information or any other attribution.”