Listen to the podcast

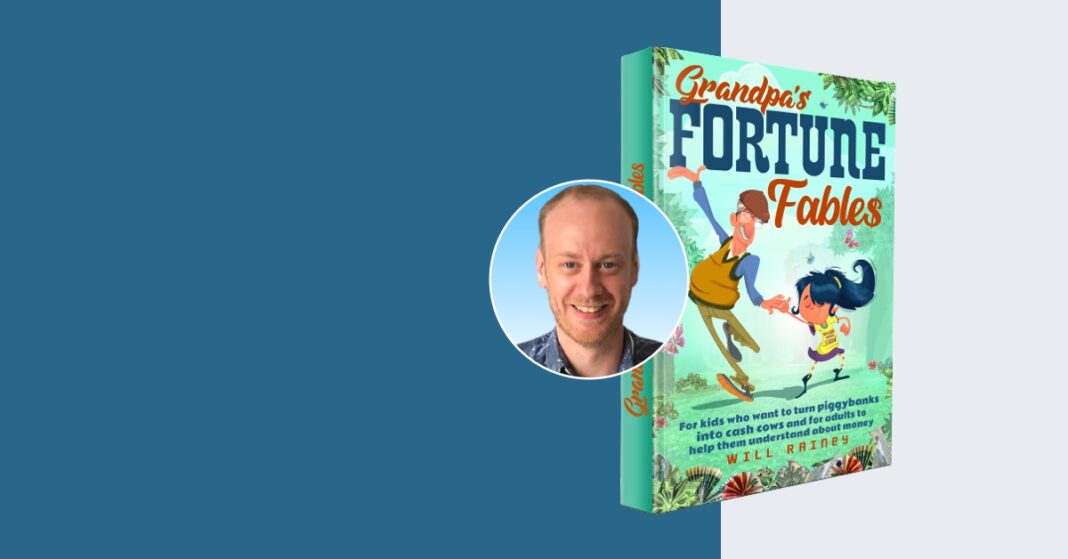

Interview with Will Rainey, Grandpa’s Fortune Fables

“This isn’t taught in school. I’m not sure why schools don’t teach kids about starting their own businesses.” That’s the view of Gail, the main protagonist in Grandpa’s Fortune Fables, a book written by my latest guest, Will Rainey.

After spending the best part of two decades working as an investment consultant, Will has now shifted focus onto financial education and teaching the next generation (as well as the adults alongside them) about finance and how to handle money.

“I was actually talking to and advising some of the world’s largest institutions about where to put their money,” Will tells me when speaking about his life prior to writing his new book.

“In 2019, my wife and I have got two young daughters and we said whilst they’re still young, let’s make some more time for them, so I moved from doing investment consulting to saying, right, what do I want to do?

“Given I was spending time with my daughters I thought I’m going to try and teach them about money.”

This was the start of Will’s journey into turning financial education into something vibrant enough for kids to take notice of.

“From that, I started talking about stories and analogies and sharing them with other people and that was the birth of Blue Tree Savings, the company that I now have, which is focussed on helping parents teach their kids about money.”

It started by blogging

“[Blue Tree Savings] started off just writing blogs and articles to help parents tackle some of the topics that most parents want to talk to their children about but didn’t know where to start.”

From there, Will spent time visiting companies that wanted to provide financial education as part of wellbeing programmes.

“Whilst I was saying you should do this for your kids, a lot of the parents’ feedback was that was really good, I’m going to start doing that not just for my kids but for myself.”

Writing the book

“I started writing these mini-stories to really focus on a topic…so what I wanted to do is say can I put all these little stories together and put it into an overarching book?”

This process led to Will writing and publishing Grandpa’s Fortune Fables, a book aimed at providing kids with a financial education, but with the additional benefit of helping parents to learn more at the same time.

“Most adults are never taught about investing, so actually most parents have probably got the same level of knowledge as most of the children.

“I do believe that even if [finance] was taught in schools it should also be taught at home.”

The art of being good with money

A key theme of the book is teaching kids how to be responsible with money.

“There are two different parts to being good with money…there’s financial knowledge, that’s knowing what is inflation, what is tax, what is debt, what is investing? Sometimes good knowledge doesn’t always lead to good outcomes.

“[That’s where the other part] comes in, it’s about behaviours and having a goal. Even when I have seen schools doing financial education, a lot of it is on the knowledge side.”

Elaborating on this point, Will explains it as knowing “the difference between rich and wealthy.”

Teaching parents via kids

“What I’ve seen is if parents do talk to their kids about money there’s a catalyst for them to start looking after their own money.”

Clearly, there’s a gap in many people’s financial knowledge that Will is hoping to fill.

“In time, I think there’s going to be a bigger and bigger push to have schools teaching kids about money, I think it’s just such an important part of life.

“Back in the baby boomers’ age where they had the defined benefit retirement schemes most people didn’t have to think about saving too much, it was kind of done for them. Now that’s not the case and people are going to have to look after their own retirement and be self sufficient moreso than ever before.”

Who should be teaching people about finance?

I asked Will for his thoughts on who is responsible for teaching kids and adults about finance; whether it’s schools, peers or financial institutions.

“We are starting to see more financial institutions start to talk about financial education which is fantastic, as long as it’s coming from a good place of seeing financial education to actually educate rather than try and educate into a product or a solution.”

Technology also plays a huge role and, as we discussed, can also present new challenges.

“One of the big worries at the moment is that we have these direct debit cards for children; whilst I think they’ve got the potential to be really good tools, if they don’t have the financial education behind them, most children will see that as a nice fun toy…it’s more dangerous than if they just had cash and saw that money disappear [when they spend it].

“Ultimately cash and using coins and notes for teaching kids about money is by far the best because it’s visible…they can see a transaction taking place, they can see the money they did have and that it’s now gone.

“In the new cashless world, money is invisible.”

It’s fair to say, Will is doing his best to make money more visible for more people.

You can purchase Will’s new book, Grandpa’s Fortune Fables on Amazon now.